Navigating a New Era of Email Lead Gen: ABD Direct’s Perspective on Digital Co-Ops

Finding new donors feels as if it’s never been harder. Rising ad costs, shrinking grassroots donor pools, and increased competition in inboxes have forced nonprofits to rethink how they grow. For years, email list building relied on ad platforms like Meta and Google, but those channels now offer more restricted targeting at higher costs. All this has culminated in a decline in spending on email lead gen. According to the latest M+R Benchmarks report, only about 10% of digital ad budgets go toward lead generation—a steep decline from 23% in 2019.

We know that for our clients, the problem isn’t a lack of demand for new supporters—it’s a lack of proven, scalable sources to find them. That’s where digital co-ops come in.

What Digital Co-Ops Really Are

Digital co-ops are databases managed by private companies that combine donor and behavioral insights from dozens to hundreds of participating nonprofits. All of these inputs from co-op members allow the co-ops to provide modeled audiences of the people who are most likely to engage with a specific cause. It’s an idea rooted in direct mail co-ops but re-imagined for digital channels. Members contribute data, and in return, gain access to prospects who are known to be actively engaging on other email lists, donating to nonprofits, and supportive of similar causes.

When used correctly, co-ops can deliver names at a fraction of the cost of paid social or display acquisition—often $1 to $2 per lead versus $2 to $10 elsewhere. But co-ops are not plug-and-play solutions. The organizations that successfully convert these leads to donors and see a return on their investment are those that pair co-op lead gen with strategic planning across three critical program areas: content development, email deliverability, and evaluation.

Build Before You Buy

When prospects are acquired from a digital co-op, the signals that have identified them as likely donors are fresh, and you must move quickly to convert them. Since time is of the essence, a solid infrastructure must be in place from the start. The first element of your program they’ll encounter is your welcome series.

We could write an entire post about new lead onboarding, but there are some specifics to keep in mind when onboarding co-op leads. It’s worth explicitly noting that these individuals have not opted in to your email program. For that reason, we advise many clients to include a topper on the first message similar to the one below, which we believe still reflects an ethical approach to opt-out lead gen:

You are receiving this email because you’ve shown interest in similar mission-driven organizations that are fighting to make our communities safer and more equitable. If you’d like to stop receiving these emails, you can unsubscribe here or receive fewer emails here.

Because you’re often delivering your welcome series to thousands of digital co-op prospects, it also presents an excellent opportunity for testing your welcome series. Testing for one client’s co-op lead onboarding revealed that reducing the cadence to a one-email welcome from a four-email series yielded significant improvements in conversion and revenue (results below).

| Profile | Total Names | Donors | Conv. Rate | Gifts | Raised | Unsubs | % Unsub |

| 4-email welcome | 16,154 | 88 | 0.54% | 144 | $5,963 | 144 | 0.89% |

| 1-email welcome | 16,023 | 117 | 0.73% | 167 | $8,069 | 167 | 1.04% |

The shorter, 1-email series outperformed the longer 4-email series in both donors (+33%) and total revenue (+$2,105.63). Although unsubscribes were slightly higher (+0.15%), this tradeoff is minor relative to the revenue lift.

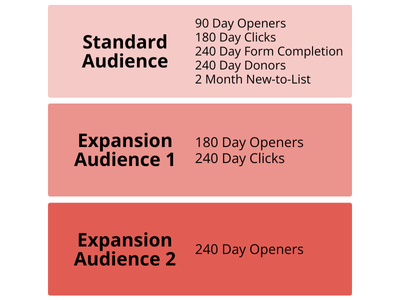

After completing the welcome series, digital co-op prospects will enter your wider mailing universe, and when they do, it’s essential that you’ve built queries that protect your deliverability. To be clear, digital co-op prospects tend to be very active and can even improve the email engagement rates for a nonprofit’s email list. However, when incorporated as an ongoing strategy, they can also grow lists rapidly, which can lead to an increase in the share of inactive subscribers on your email list over time. To mitigate this, we ensure that all our nonprofit partners who invest in digital co-ops have email queries built around their email engagement history. A typical search for our clients often looks like the one below.

The standard audience ensures that email service providers receive signals most frequently from only your most engaged supporters. Expansion audiences are used less frequently to re-engage supporters who fall outside the standard audience. This strategy is essential during rapid list growth that accompanies investments in digital co-ops.

So your welcome series is tested, and your email queries ensure industry-leading deliverability…easy enough (😅)! The final piece of the puzzle for successful digital co-op investments is the evaluation.

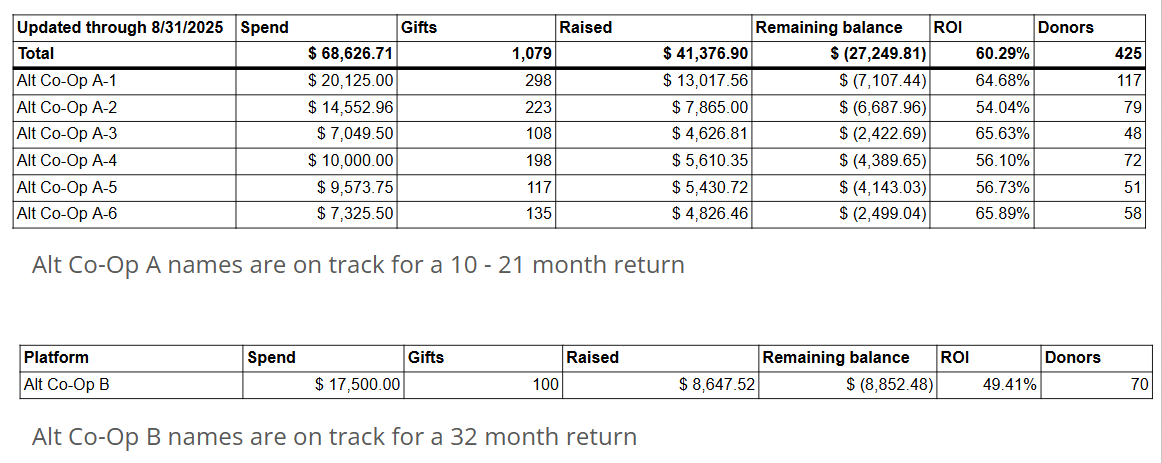

We use long-term ROI as the primary KPI when evaluating digital co-op buys for nonprofits because it provides a clear estimate of the time it takes for an investment to break even, and it allows for a head-to-head comparison against other traditional lead generation sources and competing co-ops.

We’ve tested multiple digital co-ops for our clients, including The Digital Co-Op from MissionWired, DataAxle’s DonorBase, and soon Moore’s SimioCloud. We want to understand how prospects acquired from each respond to various organizations’ messages. Each co-op has its own modeling approach, demographic mix of prospects, and cost structure. Testing across several helps guide initial and future investment decisions and provides continued options for scale when a single co-op source shows diminishing returns.

Pictured is an anonymized sample of ROI analysis comparing the long-term returns of co-ops against one another. This data informs future spending for ABD clients.

While the diversification of co-op investments can drive success, we’ve also learned that not every co-op is the right fit for every nonprofit. A co-op’s membership influences the ideological composition of its modeled audiences. When a nonprofit’s donor universe does not align with the makeup of a co-op’s data inputs, results can lag—even if that co-op performs well elsewhere. Understanding these nuances is a foundational part of our recommendations and one of the reasons ABD tests across multiple co-ops rather than assuming that strong performance translates for everyone.

Our Point of View

Despite their promise, digital co-ops remain under-discussed and taboo in some corners of the industry. Many fundraisers hesitate to engage because co-ops aren’t built on traditional opt-in tactics, even though they are legally compliant and widely used by leading nonprofits. Bringing this conversation into the open—how the data exchange works, how privacy is protected, and how ethical marketing can coexist with good data science—is essential for the sector’s growth.

ABD Direct believes that digital co-ops represent an evolution in donor acquisition. They’re not a shortcut; they’re an integral part of a robust strategy. With rigorous testing, transparent measurement, and good data hygiene, they can be a sustainable engine for long-term file growth.

Co-ops emerged as part of ABD’s broader commitment to our value of ‘Know Your World‘—studying the market, listening to data, and finding scalable opportunities for our clients. We will continue to evaluate co-ops critically, invest where the numbers justify it, and pursue complementary or alternative lead gen and donor acquisition sources whenever necessary.

Want to receive future newsletters from us directly to your inbox? Sign up for Fundraising Forward here.